Research

My research interests include financial engineering, Monte Carlo simulation, and nonlinear optimization. I especially enjoy doing research in the intersection of these fields such as statistical learning, portfolio optimization, efficient simulation algorithms for risk management, etc. My professional background in actuarial science guides my research towards applying advanced theoretical methodologies to solve complex practical problems.

Green Simulation

|

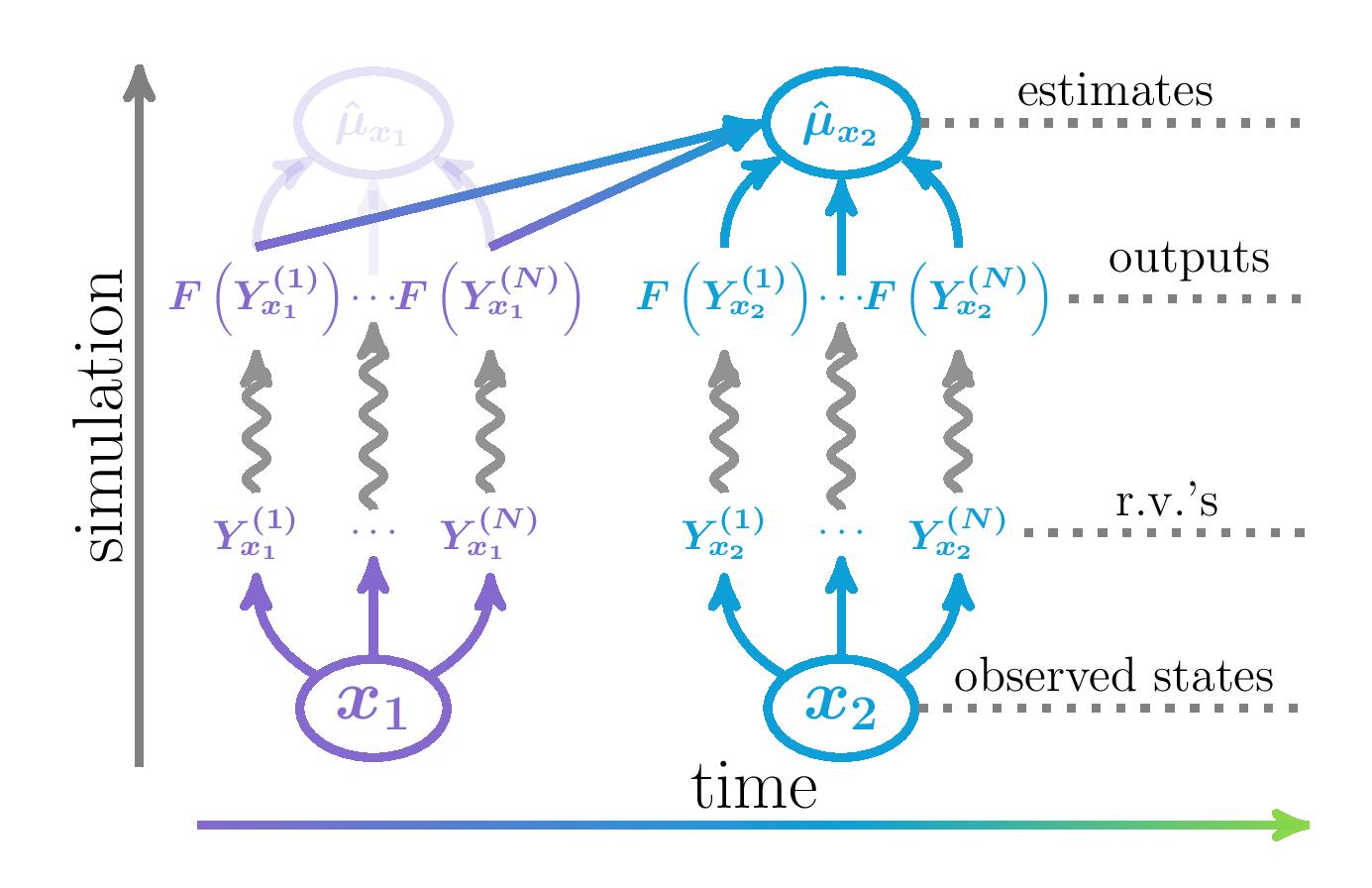

In many financial, actuarial, industrial applications, simulation models are often run repeatedly to perform the same task with different inputs due to changing market conditions or system states. “Green simulation” is the practice, currently under development, of reusing simulation output generated during previous experiments to increase the computational efficiency of the current experiment. Our research aims to develop efficient methods of output recycling and to examine their theoretical properties and practical performances. |

Papers

Green Simulation: reusing the output of repeated experiments

Mingbin Feng, Jeremy Staum

Submitted to Management Science (2016)

Abstract Tech Report

Green Simulation Designs for Repeated Experiments

Mingbin Feng, Jeremy Staum.

Proceedings of the 2015 Winter Simulation Conference, ed. L. Yilmaz, W. K. V. Chan, I. Moon, T. M. K. Roeder, C. Macal, and M. D. Rossetti, IEEE Press, 403-413.

Abstract Tech Report

Systemic Risk Components in a Network Model of Contagion

|

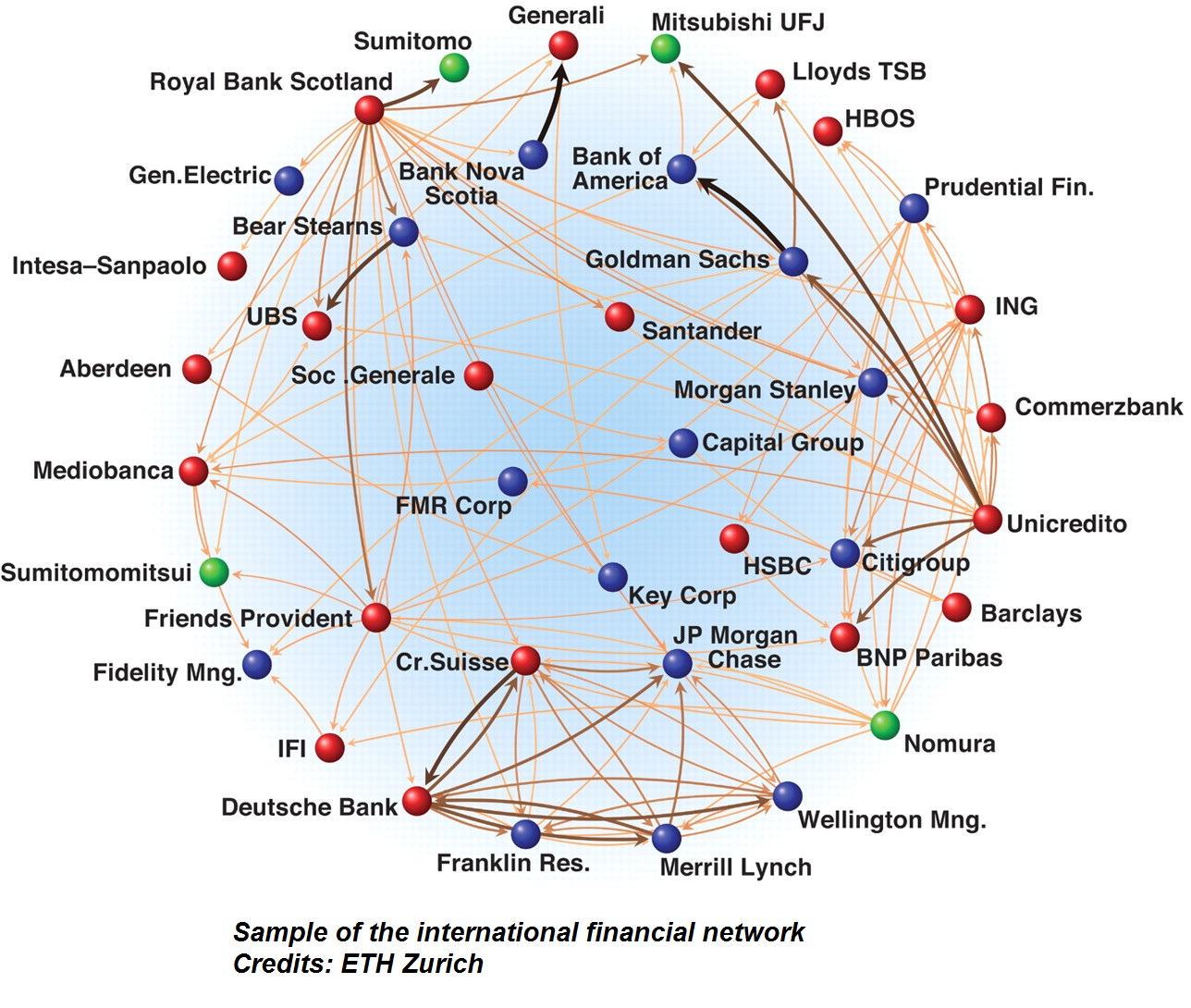

Financial entities around the globe are interconnected and this giant global financial network requires sophisticated systemic risk management. This research addresses the question of risk attribution, “Who contributed how much risk to the network's overall systemic risk?”, which is a key question in systemic risk management. Seven risk attribution methods are developed to suit different systemic risk management objectives in different time and scale. |

Papers

Systemic Risk Components in a Network Model of Contagion

Jeremy Staum, Mingbin Feng, and Ming Liu

Forthcoming, IIE Transactions.

Abstract Tech Report

Practical Algorithms for Value-at-Risk Portfolio Optimization Problems

This article compares algorithms for solving portfolio optimization problems involving value-at-risk (VaR). These problems can be formulated as mixed integer programs (MIPs) or as chance-constrained mathematical programs (CCMPs). We propose improvements to their state-of-the-art MIP formulations. We also specialize an algorithm for solving general CCMPs, featuring practical interpretations. We present numerical experiments on practical-scale VaR problems using various algorithms and provide practical advice for solving these problems.Papers

Practical Algorithms for Value-at-Risk Portfolio Optimization Problems

Mingbin Feng, Andreas Wächter, and Jeremy Staum

Quantitative Finance Letters 3.1 (2015): 1-9.

Tech Report Link

Link

Coherent Distortion Risk Measures in Portfolio Selection

The theme of this paper relates to solving portfolio selection problems using linear programming. We extend the well-known linear optimization framework for Conditional Value-at-Risk (CVaR)-based portfolio selection problems and to optimization over a more general class of risk measures, known as the class of Coherent Distortion Risk Measure (CDRM). CDRM encompasses many well-known risk measures including CVaR, Wang Transform, proportional hazard measure, lookback measure, etc. A case study is conducted to illustrate the flexibility of the proposed optimization scheme. In the case study we compare and contrast the efficiency of the 1/n-portfolio strategy and the optimal portfolios with respect to different CDRMs.Papers

Coherent Distortion Risk Measures in Portfolio Selection

Mingbin Feng, Ken Seng Tan

Systems Engineering Procedia 4 (2012): 25-34.

Tech Report Link

Link

Complementarity Formulations of L0-norm Optimization Problems

In many application it may be desirable to obtain sparse solutions. Minimizing the number of nonzeroes, L0-norm, of the solution is a difficult nonconvex optimization problem and is often approximated by the convex problem of minimizing the L1-norm. We consider exact formulations as mathematical programs with complementarity constraints and their reformulations as smooth nonlinear programs. We discuss properties of the various formulations and their connections to the original L0-minimization problem in terms of stationarity conditions, as well as local and global optimality. Numerical experiments using randomly generated problems show that standard nonlinear programming solvers, applied to the smooth but nonconvex equivalent reformulations, are often able to find sparser solutions than those obtained by the convex L1-approximation.Papers

Complementarity Formulations of L0-norm Optimization Problems

Mingbin Feng, John Mitchell, Jong-Shi Pang, Xi Shen, Andreas Wächter

Working paper.

Tech Report Link

Link