Credit Risk Modeling

- Developed a model for dependent lifetimes of components in a system, which enables efficient simulation

for large dimension problems and can be used in a wide range of applications, including modeling credit risk.

- Co-authored the paper "Marshall-Olkin Multivariate Exponential Distributions, Multidimensional Levy

Subordinators, Efficient Simulation, and Applications to Portfolio Credit Risk". To be submitted for publication.

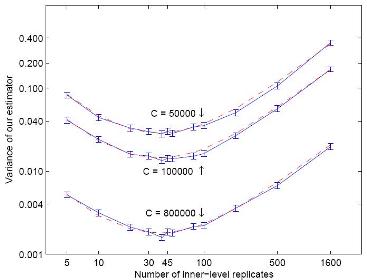

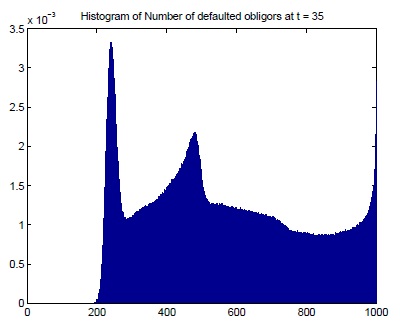

- The right figure shows the special feature of distributions of the default counting process at a specific time.

- Will develop a bottom-up CDO pricing model based on it, and calibrate the model to market data.